Become a Part of Our Powerful Community

Connect with professionals around the globe who share their knowledge, collaborate, and help each other grow.

Grow

Develop new skills, learn, & share knowledge and experiences.

Collaborate

Connect with professionals worldwide and create amazing things together.

Contribute

Inspire others and make an impact by giving back to the community.

Share Knowledge, Find Answers

Meet Other

Web Creators

Join events online and in-person and connect with web designers, developers, marketers, and Elementor experts. Get inspired, network, and grow your business.

Become a Leader

Lead and grow your local and global community of web creators, inspire other members, & empower creators.

Make Your Mark on Elementor

Empower web professionals in your native language by localizing Elementor plugins.

- Translate Elementor so others can use and learn it in your native language.

- Make your clients happy by translating Elementor into their local language.

Join Our

Educator Program

Take your courses to the next level by accessing valuable resources, networks, and so much more.

- Get news & updates before anyone else and create exclusive content for your audience.

- Become the best educator possible with our top-notch training resources.

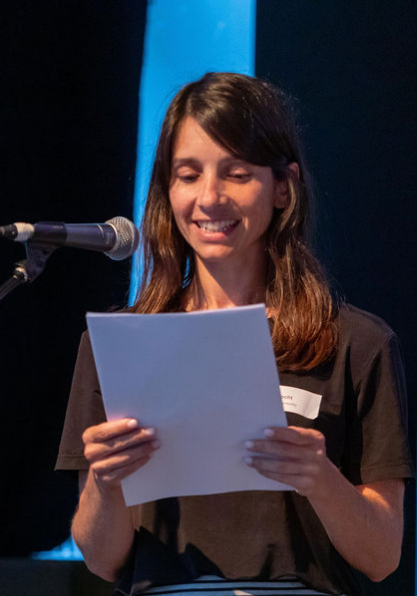

Speak

Speak at

Community Meetups

Share your knowledge with other Elementor users and engage with the community.

- Inspire other web creators with your experiences and insights.

- Share your passion and knowledge on the perfect stage.

Add to Your Own Code

Access Elementor’s code references, extend Elementor, and build your own add-ons.

- Learn how to extend Elementor, and create your own addons and extensions.

- Contribute code and suggest new ideas in Elementor’s GitHub repository.

Showcase Your Web Creations

We’re very proud of the incredible content Elementor users create.

Browse for inspiration or get your own project featured.

Code of Conduct

Our Community guidelines are designed to help facilitate this forum, and set the standard for the behavior and conduct we expect. This code of conduct applies to everyone in the Elementor Community, including users, leaders, partners, and our employees.

Join Our Community Groups

Facebook Group

Help other community members, learn Elementor, answer ‘how-to’ questions, and connect with web creators.

Spanish Community

Join our Spanish community to exchange knowledge, share hacks, and get support in your native language.